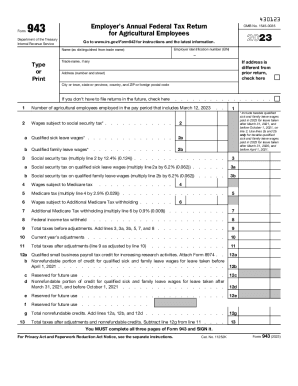

IRS 943 2024-2025 free printable template

Show details

Don t use Form 943-V to make federal tax deposits. Use Form 943-V when making any payment with Form 943. Don t send cash. Don t staple Form 943-V or your payment to Form 943 or to each other. Detach Form 943-V and send it with your payment and Form 943 to the address provided in the Instructions for Note You must also complete the entity information above line 1 on Form 943. Check if self-employed PTIN Firm s EIN Phone no. Cat. No. 11252K 943 2024 430621 This page intentionally left blank...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 943

Step-by-step Instructions for Modifying Form 943

Guidelines for Completing IRS Form 943

Understanding and Utilizing IRS Form 943

IRS Form 943 is a vital document for agricultural employers. It's specifically used to report annual federal income tax withholding, Social Security tax, and Medicare tax for employees in the agricultural sector. Effectively navigating this form is crucial to ensure compliance with federal tax regulations.

Step-by-step Instructions for Modifying Form 943

Editing IRS Form 943 may require specific adjustments based on your unique business circumstances. Follow these clear steps:

01

Obtain the latest version of IRS Form 943 from the official IRS website or your tax professional.

02

Review the previous year’s entries if applicable, to ensure consistency and accuracy.

03

Identify sections needing changes, such as the employer identification, employee details, or tax calculations.

04

Make necessary adjustments while cross-referencing IRS guidelines to ensure compliance.

05

Print or save the edited form according to your filing preference (electronic vs. paper submission).

Guidelines for Completing IRS Form 943

Completing the IRS Form 943 involves several key steps that require careful attention:

01

Fill in your employer information in the upper section, including your name, address, and Employer Identification Number (EIN).

02

Detail the total wages paid to employees during the year.

03

Calculate the amounts withheld for federal income tax, Social Security tax, and Medicare tax based on your records.

04

Sign and date the form, confirming the accuracy of the information provided.

05

Submit the form by the specified deadline, ensuring to keep a copy for your records.

Show more

Show less

Recent Updates and Changes Impacting IRS Form 943

Recent Updates and Changes Impacting IRS Form 943

Recently, there have been significant updates to IRS Form 943. For the 2023 tax year, changes include:

01

Increased earning thresholds for eligibility for certain exemptions.

02

New reporting requirements for specific agricultural subspecialties.

Essential Insights into the Functionality and Application of IRS Form 943

What is IRS Form 943?

What is the Purpose of IRS Form 943?

Who Needs to File Form 943?

Applicable Exemption Criteria

Breakdown of IRS Form 943 Components

Filing Deadline for IRS Form 943

Comparing IRS Form 943 with Similar Tax Forms

Transactions Covered by IRS Form 943

Submission Copies Required?

Penalties for Non-Compliance with IRS Form 943

Information Required for Filing IRS Form 943

Additional Forms Typically Needed Alongside IRS Form 943

Where to Submit IRS Form 943

Essential Insights into the Functionality and Application of IRS Form 943

What is IRS Form 943?

IRS Form 943 serves as a tax return specifically designed for agricultural employers to report employee wages, federal income tax withheld, and FICA taxes for the agricultural workforce. Its primary function is to ensure compliance with federal tax requirements for businesses in this sector.

What is the Purpose of IRS Form 943?

The primary purpose of IRS Form 943 is to facilitate accurate reporting of federal employment taxes owed by agricultural employers, ensuring both compliance and proper collection of funds necessary for Social Security and Medicare programs.

Who Needs to File Form 943?

Form 943 is required for agricultural employers who paid wages of $150,000 or more (based on their employees’ agreements) in the calendar year or had 10 or more employees during any day in the calendar year. This includes farmers, ranchers, and others with direct agricultural activities.

Applicable Exemption Criteria

Exemptions from filing IRS Form 943 apply under certain conditions:

01

Employers with total agricultural income below $150,000.

02

Employers with no employees within certain contract farming scenarios.

03

Specific industries can also qualify based on unique operational conditions.

For example, a farmer employing only seasonal workers part-time during harvest seasons may not reach the filing threshold, thus being exempt.

Breakdown of IRS Form 943 Components

IRS Form 943 comprises various components that must be completed, including:

01

Identification of the employer and employees

02

Total wages paid

03

Income tax withheld

04

Social Security and Medicare tax calculations

Filing Deadline for IRS Form 943

The deadline for submitting IRS Form 943 is January 31st of the following year. Any employer required to file must ensure that the form is completed and sent to the IRS by this date to avoid penalties.

Comparing IRS Form 943 with Similar Tax Forms

IRS Form 943 differs from Form 941 (the Employer's Quarterly Federal Tax Return) in that 943 is specifically dedicated to agricultural employers, while 941 is broader, covering various industries. While both forms report employee wages and tax withholdings, their applicability varies based on the nature of employment.

Transactions Covered by IRS Form 943

This form covers transactions related to wages and associated contributions including:

01

Salaries and hourly wages paid to agricultural workers

02

Bonuses and incentives directly tied to agricultural labor

Submission Copies Required?

Typically, employers must submit one original Form 943 to the IRS. It's advisable to maintain additional copies for your business records.

Penalties for Non-Compliance with IRS Form 943

Failing to submit IRS Form 943 can result in severe penalties. Examples include:

01

A minimum penalty of $50 for failing to file, which increases based on the length of delay.

02

Failure to pay the required taxes can incur penalties reaching up to 25% of the owed amount.

03

Legal repercussions may also follow persistent non-compliance, leading to enforced collections.

Information Required for Filing IRS Form 943

Key information necessary for completing Form 943 includes:

01

Employer Identification Number (EIN)

02

Total number of agricultural workers

03

Wages paid and taxes withheld during the year

Additional Forms Typically Needed Alongside IRS Form 943

In many cases, employers may need to accompany IRS Form 943 with:

01

Form 940 for federal unemployment tax reporting

02

W-2 forms for reporting wages paid to employees

Where to Submit IRS Form 943

Submit your completed IRS Form 943 to the address specified in the instructions. Ensure it's sent to the appropriate address based on whether taxes are due or if the form is filed without payment.

By understanding IRS Form 943 and the necessity of timely filing, agricultural employers can avert potential complications and ensure compliance. Should you need further assistance or tools for completing IRS Form 943, consider reaching out to applicable tax professionals or utilizing reliable tax software.

Show more

Show less

Try Risk Free